Bitcoin and altcoins started this morning with a decline. BTC generally hovered around $66,000 during the day until it reached over $67,000 yesterday.

However, Bitcoin, which experienced a sharp decline overnight, dropped to $63,800. Although there is no clear reason behind the decline in Bitcoin, the decline in Ethereum and altcoins appears to be due to outflows in spot Ethereum ETFs.

Ethereum (ETH) is down 7.6% today to $3,100 despite the recent ETH ETF launch, while Solana (SOL) is down 1.7%; Dogecoin (DOGE) 5.5%; BNB fell 3.6% and Avalanche (AVAX) fell 4.8%.

According to SoSoValue data, there was a net outflow of over $810 million from Grayscale’s ETHE. These outflows are similar to Grayscale’s other large fund, GBTC, which experienced intense outflows in the first weeks after the approval of spot Bitcoin ETFs. BTC price also overreacted to the BTC outflows from Grayscale in the first weeks.

Also Read: Solana Touted as Top Blockchain for RWA by Industry Leader

Except for the Grayscale ETF, most other ETH ETFs remained in the green zone on Wednesday. BlackRock’s ETHA led the way with an inflow of $283.9 million, followed by Bitwise’s ETHW with an inflow of $233.6 million, and Fidelity’s FETH in third place with an inflow of $145.7 million.

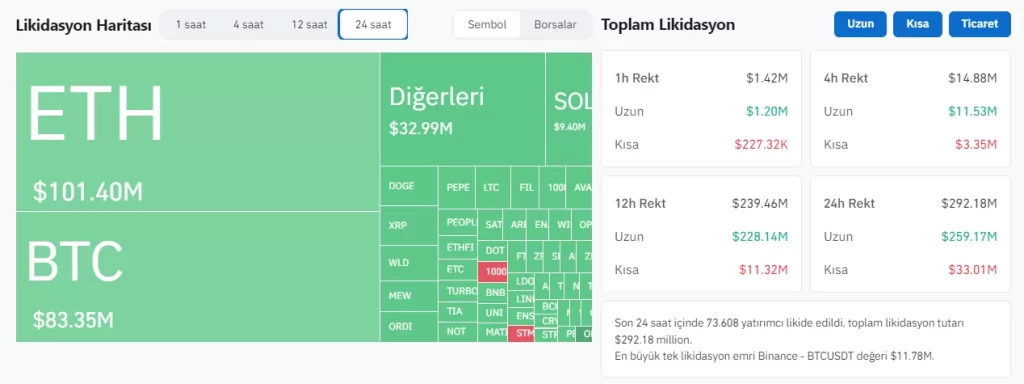

These declines caused many long positions to be liquidated. According to Coinglass data, $292 million in leveraged transactions were liquidated in the last 24 hours. Of these, $259 million consisted of long positions and $33 million consisted of short positions.

In the last 24 hours, 73,612 investors were liquidated, with the largest single liquidation order on the BTC/USDT trading pair on Binance. The transaction was valued at $11.78 million.