Solana has become the first non-EVM blockchain adopted by real-world asset (RWA) tokenization firms. Libre, backed by major financial players like Nomura and Brevan Howard, has chosen Solana for its RWA initiatives.

The Emergence of Tokenized Real-World Assets

Tokenized Real-World Assets (RWA) represent a cutting-edge blockchain sector, transforming traditional financial assets such as bonds, stocks, funds, and property into tokens for faster, easier, and more efficient trading. Leading traditional finance (TradFi) institutions, including BlackRock, have already entered this space.

Libre’s Strategic Adoption of Solana

At its launch, Libre’s CEO Avtar Sehra highlighted Solana’s robust infrastructure suited for RWA assets and its superior scalability. Solana’s high throughput and low latency were key factors in Libre’s decision to utilize it for secondary trading services on all their asset offerings. Later this year, Libre will enable secondary trading on multiple assets, available to Solana users from day one. Besides speed and scalability, Solana also benefits from low transaction costs.

Libre is a collaborative venture between Brevan Howard-backed WebN Group and Nomura-backed Laser Digital, focusing on developing tokenized real-world assets.

Also Read: Ethereum Price to React Strongly to ETF Inflows, Says Kaiko

Why Solana Stands Out

Solana’s edge over other blockchains like Ethereum or Cardano lies in two main factors:

- High Scalability: Solana processes real-time transactions at 3,500 per second, with a maximum capacity of 65,000 transactions per second. In contrast, Ethereum supports up to 119 transactions per second, even after its Dencun upgrade. Scalability is crucial for RWA, as the real world can experience sudden surges due to FOMO or panic selling.

- Low Latency: Solana’s block time is currently 0.8 seconds, facilitating real-time settlement, essential for the speed and efficiency of RWA. Ethereum’s block time is about 12 seconds. This low latency ensures users have full ownership of their purchased tokens almost instantaneously, unlike traditional settlement systems that can take up to a week.

Solana’s Growth in 2024

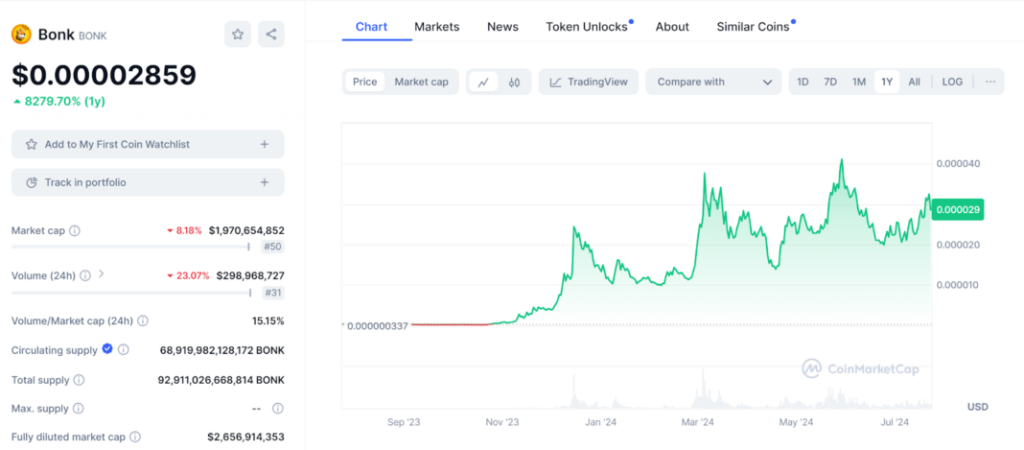

In 2024, Solana emerged as the fastest-growing major blockchain ecosystem. Beyond memecoins, it boasts strong Total Value Locked (TVL) and impressive on-chain activity. Solana memecoins were the top gainers among all cryptocurrencies in 2024, with Bonk gaining 8,200% and dogwifhat achieving a 1,400% sustained gain, signifying long-lasting value increases.

On the TVL front, Solana’s on-chain DeFi assets amount to $5.3 billion, complemented by $3.3 billion in stablecoins on its blockchain.

Focusing on Solana’s on-chain metrics, the past year has shown consistent growth. The total number of addresses on the Solana blockchain peaked in June 2024, reaching 47 million.

These metrics have positioned Solana as a top choice for tokenized real-world assets.