The price of Ether is expected to be “sensitive” to spot Ether ETF inflows in the coming days, according to crypto analytics firm Kaiko. This comes as investors recall the lackluster demand for ETH futures products late last year.

Kaiko’s head of indices, Will Cai, noted in a July 22 market report, “The launch of the futures-based ETH ETFs in the US late last year was met with underwhelming demand. All eyes are on the spot ETFs’ launch with high hopes for quick asset accumulation.”

Cai added, “Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers in the first days.”

Several spot Ether ETFs received their final approval on July 22 and are set to begin trading on July 23. Cai mentioned that one of the most significant price impacts could come from “potential” outflows from Grayscale’s Ethereum Trust (ETHE).

Much like the Grayscale Bitcoin Trust (GBTC) for Bitcoin, the Grayscale Ethereum Trust (ETHE) offers institutional investors exposure to ETH but enforces a six-month lock-up period on its shares.

The conversion of ETHE into a spot ETF will allow for easier buying and selling, prompting many investors to likely cash out after the switch to a spot product on July 23.

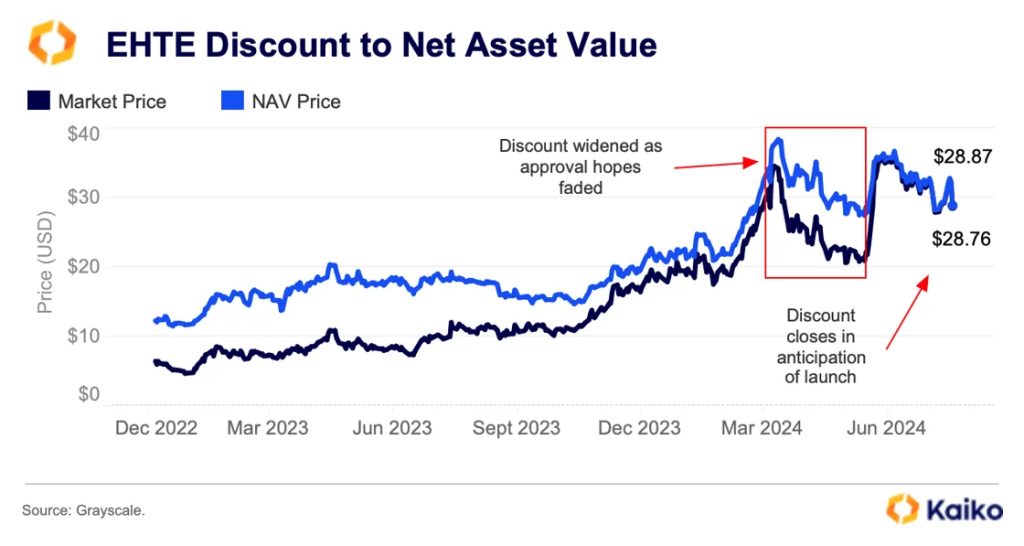

“ETHE’s discount to net asset value has closed over the past few weeks, after widening between February and May as hopes of approval waned,” added Will Cai from Kaiko. “The narrowing discount suggests traders bought ETHE below par and will redeem these shares at NAV price on conversion to realize profits.”

Also Read: Bitcoin Surges to $68,000 Following Surprise Interest Rate Cut by China

Some analysts expect ETH ETFs to underwhelm. While spot Bitcoin ETFs were a significant catalyst for Bitcoin, there’s less confidence in the popularity of Ether ETFs.

Crypto market maker Wintermute projected in a July 21 report that Ethereum ETFs would generate between $3.2 billion and $4 billion of inflows in their first year. “Our view is the ETFs will likely see lower-than-anticipated demand, closer to $3.2 to $4 billion,” wrote Wintermute.

In contrast, Wintermute expects Bitcoin ETFs to generate around $32 billion in assets by the end of the year, suggesting that ETH ETF inflows would be about 10 to 12% of Bitcoin ETF flows.

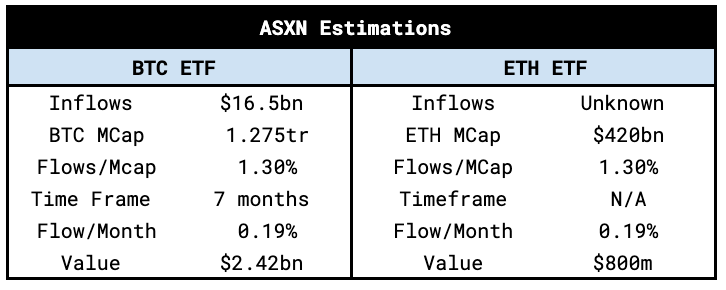

Wintermute predicts that the price of ETH will rise no more than 24% by year-end. Conversely, boutique crypto asset firm ASXN provided a more bullish outlook in a July 22 post on X, predicting average monthly inflows of $800 million to $1.2 billion into ETH ETFs.

ASXN noted that it expects the price impact of ETHE outflows to be less dramatic than market fears. This is due to a tightening and dynamic discount premium to net asset value (NAV) and the launch of Grayscale’s mini ETH ETF, which they predict will alleviate outflow pressure.