The crypto market is showing strong signs of recovery, with major currencies like Bitcoin and Ethereum experiencing double-digit increases. ETF trading also sets a new monthly record.

Market Overview

After enduring significant price drops recently, the crypto market is bouncing back with impressive gains. Bitcoin has surged by 4% compared to the previous day, currently trading at $56,500. Ethereum has also seen a 4% increase, pushing its price just above the $3,000 mark.

Significant Gains

- Bitcoin: Up 4%, now at $56,500

- Ethereum: Up 4%, now just above $3,000

- Solana: The standout performer with a 9% increase, reaching $137

- Toncoin: Leading the top ten cryptocurrencies with a 15% increase, now at $7.60

Overall, the total market capitalization has risen by 5% compared to the previous day.

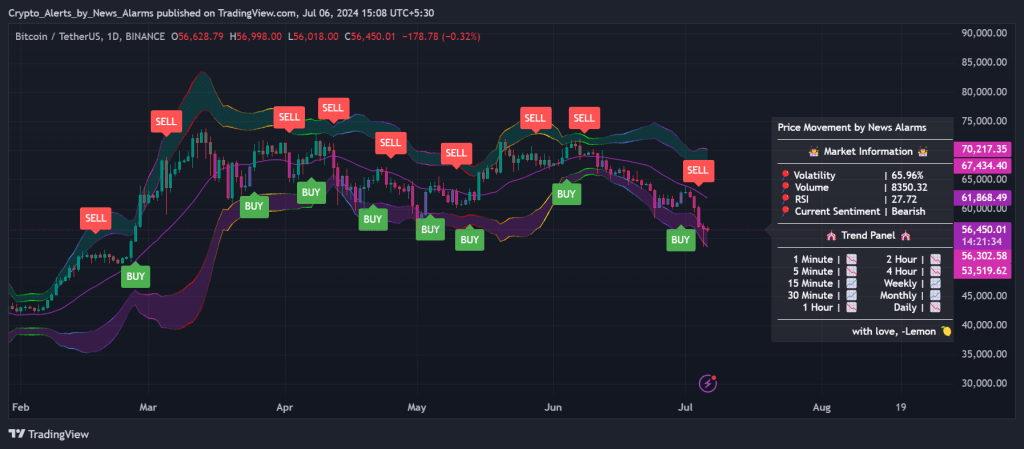

Bitcoin Price Prediction and Technical Analysis

Bitcoin’s Promising Long-Term Investment Potential

According to our Forecast System, Bitcoin (BTC) presents a strong long-term investment opportunity. Our predictions, updated every 3 minutes with the latest prices through smart technical analysis, provide insights into BTC’s future performance.

Also Read: Solana-Based Memecoin Billy Soars Amidst Crypto Market Downturn

We use technical analysis to forecast future values for a wide range of digital currencies, including Bitcoin. For those seeking virtual currencies with high return potential, BTC stands out as a profitable investment option. As of July 6, 2024, Bitcoin’s price is $56,467.10. If you invest $100 today, you would receive approximately 0.00177 BTC. Our projections indicate a significant long-term increase, with the price expected to reach $89,212.65 by June 30, 2029. Over a 5-year period, this would represent an estimated revenue growth of around 57.99%.

Also Read: KfW Launches €100 Million Blockchain Bond, Marking Digital Finance Milestone

Recent Market Turbulence

In recent days, the crypto market faced considerable disruptions, with Bitcoin’s price dropping nearly $10,000 at its peak decline during the week. However, investors have taken advantage of these lower prices, viewing them as favorable entry points.

Also Read: Mike Novogratz’s Top Tip for Learning About Crypto Investing

Record ETF Trading Inflows

This renewed investor interest has led to the largest net inflow in Bitcoin spot ETF trading for the month. According to Farside Monitoring, these inflows totaled $143.1 million, with the Fidelity Bitcoin ETF (FBTC) leading the pack with $117 million in new investments.

Conclusion

The crypto market’s recent recovery highlights the resilience of digital currencies and the growing investor confidence in their long-term potential. As Bitcoin and Ethereum lead the way, the market sentiment appears to be shifting towards a more optimistic outlook.